Tesla (TSLA 3.07%) is lately the eighth-largest corporate on the planet with a marketplace cap of simply over $1.05 trillion as of this writing.

The inventory underperformed the S&P 500 for almost all of 2024, but it surely has jumped just about 50% up to now month. The result of the U.S. elections have helped pressure Tesla’s percentage worth upper, because of the realization that CEO Elon Musk’s shut courting with President-Elect Donald Trump may just receive advantages the electrical automobile (EV) producer right through the brand new management.

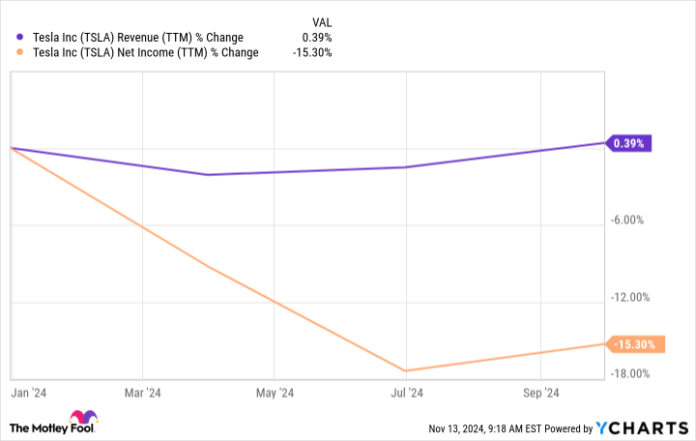

Then again, Tesla’s fresh monetary efficiency has been not up to spectacular as you’ll see beneath.

Knowledge by means of YCharts.

Tesla inventory’s underperformance via maximum of 2024 will also be attributed to rising festival that is bringing down its supply numbers, in addition to the corporate’s failure to provoke buyers with the hot unveiling of the Cybercab. Additionally, Tesla’s income are anticipated to extend at simply over 4% once a year within the subsequent 5 years, consistent with the analyst consensus, suggesting the corporate’s expansion might stay bumpy going ahead.

With this difficult outlook, it would possibly not be unexpected to peer Tesla overtaken within the checklist of global’s greatest firms. In particular, Taiwan Semiconductor Production (TSM -1.32%), popularly referred to as TSMC, and Broadcom (AVGO -3.25%) are rapid on Tesla’s heels. Each firms are anticipated to revel in robust expansion because of unheard of call for for his or her chips too.

Here is a nearer take a look at the the reason why those two semiconductor shares might be able to surpass Tesla by means of marketplace cap over the following 5 years.

1. Taiwan Semiconductor Production

TSMC is the arena’s tenth greatest corporate with a marketplace cap of round $995 billion as of this writing. It is not a ways in the back of Tesla because of its place because the main participant within the semiconductor foundry business with a marketplace percentage of 62%, consistent with Counterpoint Analysis. It enjoys a large lead over second-place Samsung, which has a foundry marketplace percentage of 13%.

This permits TSMC to profit from the secular expansion of the semiconductor marketplace, which is being pushed by means of the rising call for for synthetic intelligence (AI) programs. From smartphones to non-public computer systems (PCs) to knowledge facilities, AI is definitely impacting more than one verticals, which bodes neatly for TSMC because it manufactures chips for all of the main avid gamers serving those sectors.

From Nvidia to Apple to AMD to Qualcomm, all of the primary fabless chipmakers use TSMC’s fabrication vegetation for his or her chip production. Now not strangely, TSMC’s expansion has shot up remarkably in 2024. The Taiwan-based corporate’s income within the first 10 months of 2024 larger 31% yr over yr.

The corporate is forecasting a 30% build up in income in full-year 2024 to $90 billion, which might be a forged growth over the 9% decline it witnessed final yr. Extra importantly, the income forecast for the following couple of years has been emerging as neatly with the corporate anticipated to care for top-line expansion of round 20%.

Knowledge by means of YCharts.

Even higher, analysts be expecting this expansion to go with the flow to the base line as income build up at an annual charge of 26% over the following 5 years.

In the meantime, the inventory is buying and selling at 34 instances income, a large bargain to Tesla’s income more than one of 90. Traders taking a look so as to add a tech inventory to their portfolios will have to imagine TSMC — it will not be lengthy sooner than the corporate surges previous Tesla with a better marketplace cap.

2. Broadcom

Identical to TSMC, Broadcom could also be making the most of rising call for for AI chips. Broadcom makes a speciality of making customized chips, referred to as application-specific built-in circuits (ASICs), and it’s been billed because the second-most essential AI chip corporate after Nvidia.

Within the fiscal 2024 3rd quarter (ended Aug. 4), gross sales of the corporate’s customized AI chips larger an excellent 3.5x from the year-ago duration. That pattern will also be anticipated to proceed as Broadcom is reportedly the main participant within the customized AI chip marketplace with an estimated percentage of 55% to 60%, consistent with JPMorgan.

The funding financial institution believes Broadcom has a income alternative of $20 billion to $30 billion in customized AI chips, which might develop at an annual charge of 20% at some point. The corporate has already landed key shoppers reminiscent of Meta Platforms and Alphabet, and a up to date file from Reuters states that even OpenAI is taking a look to construct an in-house chip with Broadcom’s lend a hand.

Broadcom’s AI alternative is not restricted to simply customized chips. Its networking trade has additionally won a pleasant shot within the arm because of rising deployment of AI knowledge facilities with rapid connection wishes. The corporate’s networking income larger an excellent 43% yr over yr in fiscal Q3, pushed principally by means of the rising deployment of AI clusters by means of hyperscale cloud provider suppliers.

Due to such forged tailwinds, it’s simple to peer why Broadcom’s income are forecast to extend at an annual charge of 20% for the following 5 years. That is neatly above the expansion that Tesla is predicted to ship over a an identical duration. For the reason that Broadcom has a marketplace cap of $813 billion, it is only 27% clear of matching Tesla’s present marketplace cap. Broadcom is already the Eleventh-largest corporate on the planet, hanging it simply in the back of TSMC.

And prefer TSMC, Broadcom turns out poised to outgrow Tesla throughout the subsequent 5 years, taking into account its more potent income expansion and its tough place within the AI chip marketplace.

JPMorgan Chase is an promoting spouse of Motley Idiot Cash. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of marketplace building and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Complex Micro Gadgets, Alphabet, Apple, JPMorgan Chase, Meta Platforms, Nvidia, Qualcomm, Taiwan Semiconductor Production, and Tesla. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.