The undying auto-parts corporate posted robust bottom-line expansion.

Stocks of Goodyear Tire (GT 13.86%) had been shifting upper lately after the auto-parts corporate posted better-than-expected effects on the base line in its third-quarter profits record, appearing that its transformation plan was once beginning to repay. As of two:36 p.m. ET, Goodyear inventory was once up 13.9% at the information.

Goodyear heats up

Goodyear if truth be told neglected estimates at the most sensible line, however traders had been keen to put out of your mind that as the corporate confirmed robust margin development.

Earnings within the quarter fell 6.2% to $4.82 billion, which was once beneath the consensus of $4.94 billion. Earnings was once down in part because of divestitures, together with its off-the-road tire trade. The corporate offered 42.5 million tire gadgets within the quarter, down from 45.3 million within the quarter a 12 months in the past.

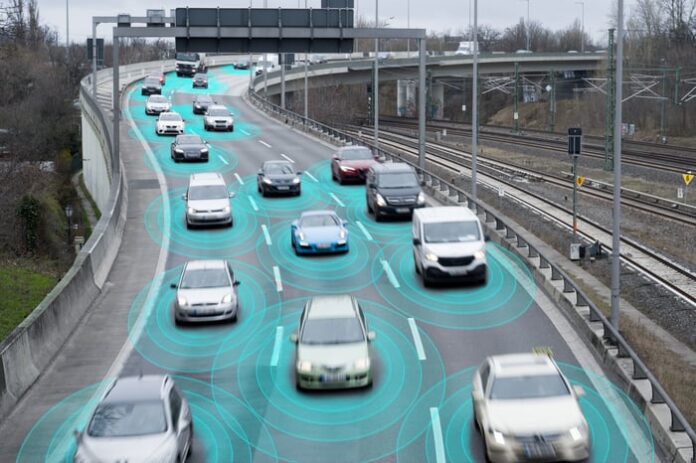

Symbol supply: Getty Pictures.

On the other hand, traders had been maximum inspired with the bottom-line efficiency as the corporate delivered its fourth consecutive quarter of phase operating-income margin enlargement. Phase working margin progressed from 6.5% to 7.2% and was once up 300 foundation issues over the past 4 quarters.

On the base line, Goodyear reported adjusted profits in keeping with proportion of $0.37, up from $0.36 within the quarter a 12 months in the past, and higher than estimates of $0.21.

What is subsequent for Goodyear

The tire business hasn’t been specifically rewarding for traders, and Goodyear Tire remains to be down sharply from its pandemic-era positive aspects. On the other hand, control believes the Goodyear Ahead transformation plan is paying off, and the making improvements to working margin is encouraging.

Control raised its steering for profits advantages from this system to $450 million in 2024 and $750 million in 2025. If the corporate continues to execute on that plan and increase its margins, the inventory looks as if a excellent guess to transport upper as stocks are affordable, in keeping with the corporate’s profits over the past 4 quarters.

Jeremy Bowman has no place in any of the shares discussed. The Motley Idiot has no place in any of the shares discussed. The Motley Idiot has a disclosure coverage.