primeimages

Through Adila McHich, Cameron Liao, Elizabeth Hui and Paul Wightman

At a Look

From herbal fuel delivery and insist dynamics to OPEC+ selections, heightened volatility may well be forward in 2025 As uncertainty persists, extra investors are turning to temporary Power choices

Power markets are gearing up for a doubtlessly tumultuous 2025 amid ongoing world conflicts, a transformation within the U.S. management, imaginable snags within the power transition, business insurance policies associated with price lists and a mixture of supply-side constraints.

Even if it might take months sooner than the incoming management’s affect at the power sector turns into transparent, some are already glaring, such because the initiative to cut back make stronger for electrical automobiles. Those elements have the possible to reshape the power panorama and give a contribution to volatility in herbal fuel, crude oil and the subtle merchandise markets.

1. Bullish Momentum Fuels Herbal Fuel Costs

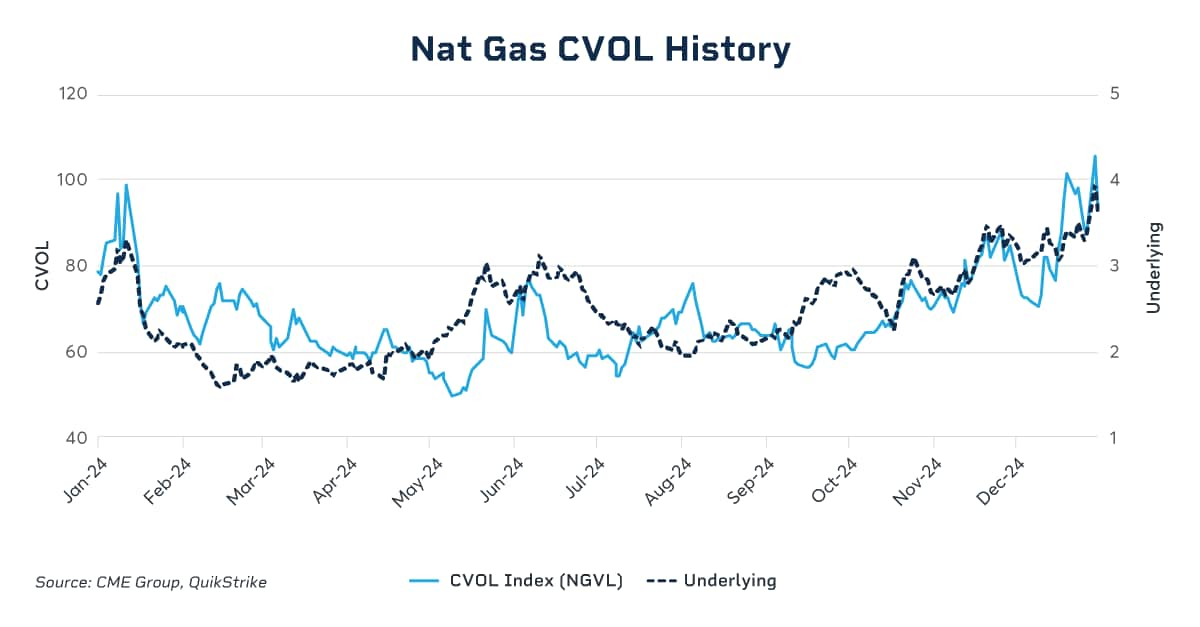

2025 is noticed ushering in a tighter demand-supply steadiness for herbal fuel, a shift prone to exert upward power on Henry Hub futures costs and raise volatility. The marketplace began this wintry weather season with warmer-than-normal temperatures, however forecasts for less warm climate reversed the upward value pattern whilst pushing up forecasts for herbal fuel intake from the residential and business sectors. In the meantime, feedgas call for from U.S. LNG export terminals is ready to stay sturdy, pushed via the competitiveness of LNG netback margin, or earnings, between U.S. as opposed to Eu and Asian markets. Fuel call for for energy era is expected to keep growing with the transition from coal to fuel.

Tighter balances and emerging herbal fuel costs would possibly inspire manufacturers to roll again fuel curtailments that have been installed position in early 2024 in keeping with weaker costs. Whilst fuel manufacturing is poised to recuperate in 2025, the incremental delivery is expected to return basically from related fuel within the Permian Basin.

Herbal fuel and LNG can be a primary beneficiary of the brand new incoming U.S. management, which is anticipated to revoke the brief pause on new LNG export licenses. The pause used to be introduced in January 2024, slowing approvals for greenfield LNG terminals and enlargement initiatives. The predicted lifting of the pause is expected to boost up investments around the herbal fuel and LNG business in 2025.

2. All Eyes on OPEC+

With oil costs near multi-year lows and expectancies for surplus oil delivery, 2025 can be a difficult yr for the Group of Petroleum Exporting Nations (OPEC). OPEC+, which contains allies like Russia, has been attempting to go back 2.5 million barrels of curtailed oil manufacturing to the marketplace since June 2024, a call it not on time for a 3rd time in December. S&P International Commodity Insights believes that any subject matter will increase in OPEC+ output in 2025 would put downward power on oil costs, which it stated may just doubtlessly ship WTI futures to as little as $30 according to barrel.

Complicating the supply-demand balancing act could be any shake-up in U.S. coverage on Iran and Venezuela. Oil manufacturing from those international locations have higher via just about two million barrels since 2020, delivery that tighter U.S. sanctions may just take away. Those imaginable curtailments may just open the door for OPEC’s desired delivery will increase, and the uncertainty round these kind of movements may just stay investors on their feet in 2025.

3. Moving Mixture of Product Call for

The Global Power Company (IEA) forecasts 2025 call for expansion of a million barrels according to day, a degree that used to be very similar to 2024. On the other hand, in 2025, greater than 50% of that call for is anticipated to return within the type of herbal fuel liquids (NGLs) like propane and butane, that are used as a petrochemical feedstock and produced principally as a co-product of herbal fuel.

From a 2019 baseline, S&P International Commodity Insights sees 2025 call for for normal oil-based fuels like gas and diesel emerging via handiest 300,000 barrels according to day. China’s call for for those fuels has peaked as investments in automobile electrification and LNG-based trucking fleets succeed in a tipping level.

This moving product combine is a problem for oil refiners in China and in different places, who’ve noticed narrowing benefit margins and introduced a chain of plant closures. Including extra power to current refiners in 2025 is new subtle merchandise delivery from the Dangote refinery in Nigeria, which remains to be ramping up manufacturing, and with the possible commissioning of the brand new Olmeca refinery in Mexico later within the yr. Refiners that undergo top prices of operations from uploading crude oil, exporting product, top power prices or the entire above are most likely applicants for extra capability explanation in 2025. Investors will carefully be staring at for those bulletins to steer value outlooks within the coming yr.

4. Biofuels and the Power Transition

A number of adjustments are anticipated within the biofuels marketplace in 2025 with a better emphasis at the position of feedstocks that ship upper greenhouse fuel financial savings to achieve extra bold carbon aid objectives. The non-traditional feedstocks similar to waste oils glance set to transform a larger function of the marketplace as governments make changes in an try to succeed in net-zero carbon emissions via 2050.

A wider vary of feedstocks is anticipated to emerge as governments evaluation the greenhouse fuel financial savings for each and every product and allow them to be used. Areas just like the Eu Union, thru their Renewable Power Directive, have already authorized a variety of biofuel feedstocks, and different international locations are starting to put into effect identical strikes.

The buying and selling of the waste feedstocks – similar to waste oils and animal fat – are anticipated to develop as a percentage of the entire biofuel delivery. Given the expansion of complicated biofuels similar to renewable diesel, the power at the delivery chains of a few key feedstocks is handiest prone to accentuate because the selection of patrons continues to increase, doubtlessly outpacing the amount of to be had merchandise out there. Different merchandise like sustainable aviation fuels were allotted their first mixing mandates via the Eu Union, the U.S. and different international locations, which can proceed to pressurize delivery chains within the years forward.

5. Will Uncertainties Encourage Extra Brief-Time period Choices Buying and selling?

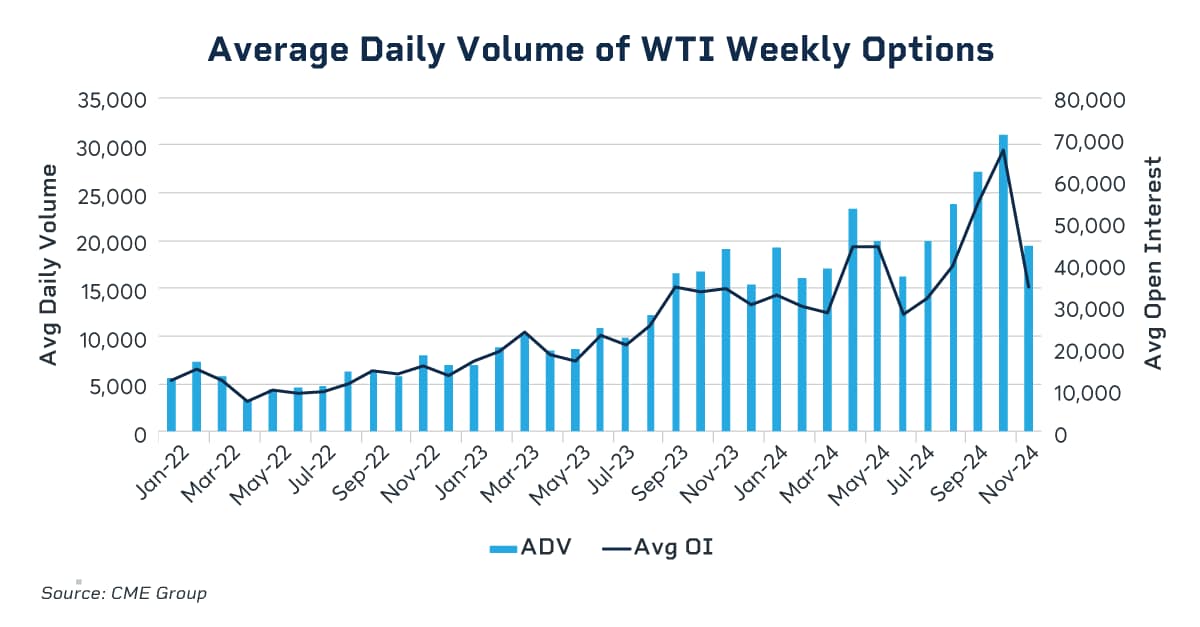

Amid the uncertainty round upcoming coverage adjustments, persevered geopolitical conflicts and slowing expansion in main economies, the power markets are at risk of vital value actions in each instructions. Enhanced value dangers have given fast upward push to the usage of temporary choices, similar to CME Workforce’s WTI Crude Oil Weekly choices, since they expire on a weekly cycle, offering investors extra exact and lower-cost equipment for managing their positions. In 2024, moderate day by day quantity in WTI Weekly choices averaged greater than 20,000 contracts, or 20 million barrels, just about quadrupled from 2022.

As value dangers persist, the enchantment of temporary power choices is prone to develop, making those equipment a key house to look at in 2025.

With such a lot of crosscurrents, 2025 can be a pivotal yr for power markets, as delivery and insist elements may well be influenced via many imaginable exterior occasions. Chance control in power markets is prone to proceed apace as investors glance to hide many unsure occasions that would spread all the way through the process 2025.

Editor’s Notice: The abstract bullets for this newsletter have been selected via Looking for Alpha editors.