Purchasing affordable shares is not the name of the game trail to wealth within the inventory marketplace. If that used to be all that traders needed to concern about, it will be extremely simple to become profitable. Inventory screeners can display which shares are the most cost effective. So traders would best want to purchase whichever shares the screener stated have been the most productive price at this time.

Actually, maximum inventory valuation metrics measure the inventory payment towards previous monetary effects. Making an investment is in regards to the long run. However even the inventory valuation metrics which are forward-looking are wrong, as a result of they are in response to estimates — and estimates are regularly improper.

Subsequently, traders want steadiness in relation to purchasing affordable shares. The valuation is essential. However having a good suggestion of what is going down on the planet and what may just occur with the industry over the following 5 years or so is essential as neatly.

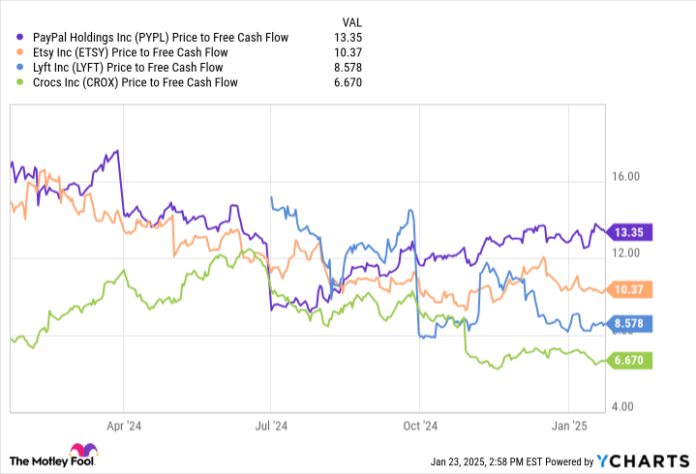

Valuation is not the entirety. However monetary era (fintech) corporate PayPal Holdings (PYPL 0.62%), e-commerce market Etsy (ETSY 2.81%), ride-sharing platform Lyft (LYFT -0.14%), and shoe industry Crocs (CROX -1.03%) are 4 objectively affordable shares. From a price-to-free-cash-flow viewpoint, PayPal is the most costly at a ratio of simply 13. That is affordable, and it best will get less expensive from there for this quartet, because the chart under displays.

PYPL Price to Free Cash Flow information by way of YCharts.

Those 4 shares are affordable as a result of traders don’t seem to be constructive about those companies from right here. However I consider they are no longer giving them sufficient credit score. Right here, I’m going to spotlight only one factor that would cross proper with every corporate, offering a possible spice up to the industry. If industry effects give a boost to, then those 4 shares are just too affordable to forget about.

1. PayPal

Possibly you’ve gotten heard that the fintech house is aggressive. It is true. Whilst PayPal has lengthy had a commanding presence with its client fintech industry via its PayPal emblem and with its Venmo app, its competitive push into endeavor fintech services and products in recent times got here at a value to its earnings.

One in all PayPal’s giant endeavor merchandise is Braintree, an unbranded checkout carrier utilized by many huge companies. To protected consumers, it seems that that the corporate used to be prepared to undercut the contest. However in a while after becoming a member of PayPal in 2023, new CEO Alex Chriss learned adjustments had to be made.

Below Chriss’ management, PayPal has began renegotiating Braintree contracts, which has lifted its benefit margins. It is so early within the adventure that the enhancements are slightly perceptible. However the chart under displays that when years of flatlining, each its gross benefit and unfastened coins stream have risen not too long ago.

PYPL Revenue (TTM) information by way of YCharts.

Buying and selling at simply 13 occasions its unfastened coins stream, PayPal inventory is a ways too affordable if its Braintree industry yields extra enhancements within the coming 12 months and past.

2. Etsy

From the 3rd quarter of 2023 via Q3 2024, energetic patrons on all of Etsy’s platforms went from 97.3 million all the way down to 96.7 million — it misplaced customers. Gross products gross sales in Q3 have been $2.9 billion, down from $3 million within the prior-year duration. Briefly, there is no expansion, and Etsy inventory is because of this affordable.

Can Etsy go back to expansion? It no doubt does have room. Control is ratcheting up its advertising and marketing to mirror how its market can be utilized for purchasing presents for friends and family. Control estimates this to be a $200 billion addressable marketplace within the U.S. by myself, and Etsy best instructions a small share of this marketplace lately.

Etsy is recently producing really extensive unfastened coins stream ($687 million over the trailing twelve months) and is the use of it to shop for again inventory. That is one thing that may spice up shareholder price and is price bearing in mind by itself. But when control’s efforts to take a larger portion of the present marketplace get started paying off, it is conceivable for the corporate to get again to expansion, making the inventory a excellent cut price lately.

3. Lyft

Like PayPal, Lyft’s industry is being checked out with contemporary eyes by way of new control. The corporate went public in 2019 and had unfavourable unfastened coins stream annually from then throughout the finish of 2023. However issues began converting after board member David Risher used to be named the brand new CEO.

In Risher’s first profits name as CEO, he stated: “I’m very conscious our present ranges of expansion and profitability don’t seem to be applicable.” It wasn’t lengthy earlier than earnings expansion picked up steam (upper costs performed an element), running bills dropped, and stock-based reimbursement got here down. The industry’ budget have been totally modified in brief order.

After unfavourable unfastened coins stream of $248 million in 2023, Lyft is on tempo to have certain unfastened coins stream in 2024 — its first complete calendar 12 months of certain coins stream. As of Q3 2024, the corporate has a surprising $641 million in unfastened coins stream on a trailing 12-month foundation. However control is not accomplished. It intends to achieve $900 million in unfastened coins stream in 2027.

For viewpoint, Lyft has a marketplace capitalization of $5.6 billion as of this writing. Imagine that it is not unreasonable for a inventory to business at 15 occasions its unfastened coins stream. Assuming it generates $900 million in 2027, Lyft can be price $13.5 billion if it traded at 15 occasions that money stream. That is a 140% acquire from the place it trades at this time.

Bearing in mind how briefly this ride-sharing industry made development below new control, I would not guess towards Lyft’s ongoing upward push.

4. Crocs

Captain Evident is aware of that Crocs the corporate makes Crocs the sneakers. This has was a super industry in recent times. No longer best are gross sales of Crocs’ clog-style sneakers rising, it is usually somewhat winning. The corporate’s running margin for 2024 will have to be round 25%, up considerably from the place it used to be a number of years in the past.

Captain Evident would possibly no longer know that Crocs additionally owns the HeyDude shoe emblem — an underperforming line that is preserving again development. The corporate received HeyDude in 2022, hoping to carry it to the similar gross sales and earnings because the Crocs emblem. That hasn’t panned out.

During the first 3 quarters of 2024, HeyDude’s earnings is down 17% from the similar duration of 2023. And margins have not come as much as the similar degree as margins for the Crocs emblem. Then again, Crocs inventory is a superb purchase regardless of this headwind. It is on tempo to earn neatly over $1 billion in adjusted running source of revenue, which it is the use of to scale back debt and repurchase stocks.

Crocs inventory is sexy as is. But when 2025 is in the end the 12 months that the HeyDude emblem begins residing as much as its doable, this inventory may just truly leap to new heights.

PayPal, Etsy, Lyft, and Crocs are a ways from companies in decline. To the contrary, I consider all 4 can wonder traders with expansion and benefit growth within the coming 12 months and past. That is why I like several 4 of those shares lately at those implausible price costs.