woraput

Expensive Investor:

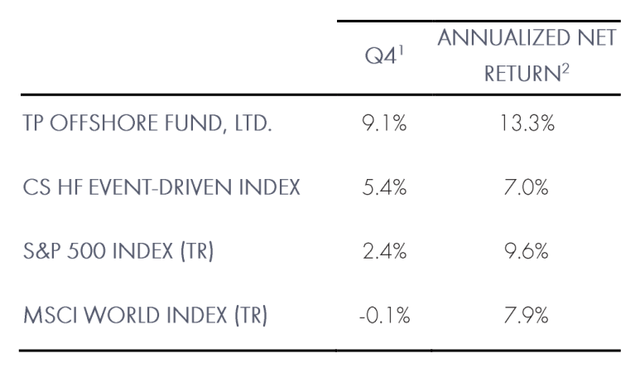

Throughout the Fourth Quarter, 3rd Level returned 9.1% within the flagship Offshore Fund. For the yr 2024, 3rd Level returned 24.2% within the flagship Offshore Fund.

1Through December 31, 2024.

2Annualized Go back from inception (December 1996 for TP Offshore and quoted indices).

PLEASE SEE THE NEW SERIES RETURNS AT THE END OF THIS DOCUMENT.

Click on to amplify

The highest 5 winners for the quarter had been Siemens Power AG (OTCPK:SMEGF), Amazon.com Inc. (AMZN), Tesla Inc. (TSLA), LPL Monetary Holdings Inc. (LPLA), and Apollo World Control Inc. (APO) The highest 5 losers for the quarter, with the exception of hedges, had been Danaher Corp. (DHR), Glencore PLC (OTCPK:GLCNF), Ferguson Enterprises Inc. (FERG), Intercontinental Alternate Inc. (ICE), and a brief place.

3rd Level’s flagship Offshore Fund generated web returns of 9.1% within the fourth quarter, and 24.2% for the total year1. Those returns had been pushed by means of sure effects throughout all methods – equities, company and structured credit score, and privates. All the way through the yr, we highlighted our various portfolio of fairness investments, some with event-driven catalysts, others with high quality traits, and several other idiosyncratic issues that differentiated our go back make-up from the S&P. As marketplace returns broadened right through the second one part of the yr, we consider we had been effectively located to take benefit. In our view, a success portfolio rotation into client discretionary, financials and commercial names helped us seize the upside of the post-election rally we predicted in our Q3 letter. This positioning drove our This autumn fairness RoA to ten.7% gross (10.1% web), outperforming the S&P 500’s +2.4% and MSCI International’s -0.1%.

Outlook

Because the November election, we now have noticed economics and coverage changing into more and more intertwined. Even though industry leaders are normally constructive about financial enlargement and diminished forms and legislation, uncertainty round positive insurance policies and techniques stays. In our view, it hasn’t ever been extra essential to make use of second-order fascinated by information headlines typically, and likely coverage declarations particularly. Up to now week, DeepSeek (DEEPSEEK), the Chinese language LLM utility, brought about a panic in generation markets, calling into query the whole lot from the long run call for for Nvidia (NVDA) chips to energy call for for information facilities. Preliminary experiences that the app used to be constructed on open-source information on antiquated chips by means of moonlighting hedge fund quants had been therefore debunked. This isn’t to mention that DeepSeek isn’t a surprising step forward, however we consider the preliminary response turns out to were overdone. We consider there are lots of firms comparable to META and others that may most likely get pleasure from the generation. In a similar way, as we noticed, the Management’s just lately introduced price lists in opposition to Mexico, Canada, and China might be much less impactful than the headlines lately implied; we see extra modest price lists, carried out by means of the Treasury and Trade departments, early this spring.

General, we predict the surroundings for making an investment in equities to proceed to be favorable, with the caveat that there can be periodic dislocations brought about by means of the radical method of this Management in conveying and enacting coverage that is affecting markets and the economic system. On this surroundings, we consider an unemotional reaction, unbiased of 1’s political opinions, is important to creating just right funding choices. We stay constructive in regards to the sectors that may get pleasure from positive of those insurance policies, in addition to an build up in M&A and different company job which feeds our event-driven framework.

New Fairness Positions

Brookfield Corp.

Final summer time we initiated a place in Brookfield Corp. (BN) Brookfield is likely one of the biggest world selection asset managers with over $500 billion in fee-earning AUM. We consider Brookfield is uniquely located to be a beneficiary of the secular enlargement tailwinds round infrastructure, the place it’s the preeminent world franchise, and personal credit score, the place this is a best participant with $250 billion in fee-earning credit score property. Those are two of the quickest rising asset categories inside possible choices.

We consider infrastructure is poised to get pleasure from the twin tailwinds of the giant world investment hole in conventional infrastructure – estimated at $100 trillion of required funding via 2040 – and demanding new call for for virtual infrastructure to give a boost to information and compute wishes. Brookfield has a protracted observe document of first quartile returns inside its world infrastructure industry and a 100+ yr historical past as an owner-operator of actual property that predates its asset control franchise. In 2022, it raised its offshoot World Transition fund at in our view an excellent $13 billion first antique, and in 2023, it closed at the biggest infrastructure drawdown fund ever raised at $28 billion.

In non-public credit score, Brookfield has blended Oaktree, which it obtained in 2019, its distinctive debt origination features in infrastructure and actual property, and a big and rising insurance coverage franchise this is writing virtually $20 billion of recent industry every year. This mixture of an origination and making an investment platform with a strong base of insurance coverage call for we consider positions Brookfield to get pleasure from the step-function enlargement we’re gazing throughout non-public credit score.

Regardless of its glaring scale, sturdy enlargement, and persisted tailwinds round asset accumulation, we consider Brookfield is an under-appreciated and under-covered fairness tale. The inventory trades at ~13x subsequent yr’s profits – extra related to the valuation of share-losing conventional asset managers than scale selection friends at 20-30x. We consider the catalysts for a re-rating are in position. Control has began to simplify the fairness tale and support its communique with traders. We consider Brookfield is a industry that has each a re- ranking alternative and robust profits compounding within the underlying asset.

Reside Country Leisure

Throughout Q2, we made an funding in Reside Country Leisure (LYV), the main built-in world live performance corporate. Having studied the industry style and control’s accomplishments for a few years, we noticed, in our view, a wonderful access level after the stocks dislocated on information of an antitrust lawsuit from the Division of Justice (DoJ). We consider LYV is about to compound profits at a double-digit fee via the following decade pushed by means of sturdy call for for concert events, powerful pricing energy, and a sizeable alternative to reinvest in owned and operated venues.

Reside Country participates in all main portions of the live performance worth chain (promotion, venue control, ticketing, and sponsorship). Concert events are a $35 billion world business that has compounded earnings at ~8% in line with annum since 2000, pushed by means of constant tailwinds in each provide and insist. Artists are desperate to excursion as a result of reside performances pressure maximum in their source of revenue and the upward push of social media and streaming track has allowed artists to briefly construct a bigger, world fanbase. The choice of artists promoting 250k+ tickets in line with excursion has risen by means of virtually 50% since 2019. Whilst Reside Country has lengthy benefited from those traits, we consider the expansion in world call for has created a in particular compelling alternative in venue building that the corporate is simply starting to capitalize on. There’s a world undersupply of live performance venues; even huge track markets comparable to South Korea and Western Europe have just a 3rd of the seating capability in line with capita of the USA. We consider Reside Country, as a well-capitalized operator with implausible information on market-by-market traits and more than one monetization vectors, is uniquely located to spend money on expanding capability at ~20%+ IRRs. The corporate is spending over $2 billion in this initiative over the following 5 years, and we consider the returns are underappreciated by means of the marketplace.

In Would possibly, Reside Country used to be sued by means of the DoJ for “illegal, monopolistic behavior” due to the 2010 Ticketmaster merger. The federal government demanded a divestiture of Ticketmaster, pointing out that the merger has pushed upper costs for lovers and “fewer actual possible choices” for venue ticketing services and products. It’s not transparent to us why keeping apart those two companies would pressure decrease costs for customers, higher results for artists, or higher provider for venues. It’s the artist who makes a decision the face worth of the price tag, whilst provider charges are set by means of and in large part get advantages the venues. Ticketmaster itself best takes about 5%-7% of gross price tag worth inclusive of charges with contracts made up our minds by means of a aggressive RFP procedure. Ticketmaster’s marketplace proportion actually seems to have declined ~10 issues because the time of the merger because of new entrants comparable to SeatGeek. We don’t consider the DoJ has cited proof of their lawsuit that LYV has violated behavioral guardrails instated in 2019 after a separate complete overview of the merger. In the end, we observe that Reside Country’s biggest promotion competitor, AEG, additionally bought a number one ticketing seller in 2019 (‘AXS’), which seems at odds with the perspectives expressed within the lawsuit. We’re constructive {that a} go back to conventional antitrust frameworks beneath the brand new Management will create a chance to talk about answers that mitigate regulator issues in regards to the business with out requiring the divestiture of Ticketmaster.

Siemens Power

We established a brand new place in Siemens Power overdue in Q3. Siemens Power is a producer of fuel generators, electric grid apparatus, and wind generators. Spun out from Siemens AG in 2020, Siemens Power’s wind industry has accrued overall working losses of just about €7 billion from 2022 to 2024 because of part disasters and poorly negotiated business contracts. We consider those stipulations ended in a significantly depressed inventory worth in spite of favorable basics within the corporate’s different industry segments. Our analysis signifies that the wind problems had been adequately provisioned for, and that menace control has considerably progressed.

As we see it, the important thing points of interest of the funding case are the resurging fuel turbine industry and the secular enlargement in grid merchandise. The expansion in renewable power technology, EV charging, and information facilities have main implications for Siemens’ merchandise. First, renewables run at best 20-30% capability utilizations and given their huge land necessities, are frequently positioned some distance from huge call for facilities. This implies we want to attach 3-4x the quantity of technology over longer distances when in comparison to conventional dispatchable technology like coal, nuclear or fuel. 2nd, the electrification of delivery in addition to call for from information facilities is resulting in enlargement in general height energy call for. Irrespective of how a lot renewable technology the sector provides, enlargement in height energy call for necessitates enlargement in dispatchable technology for the time sessions when renewables aren’t to be had. We consider those two traits have yielded a step-function build up within the call for for grid apparatus and fuel generators, two of Siemens’ core companies. Provide shortages and prolonged lead occasions have ended in a good pricing surroundings after a decade of anemic enlargement. Siemens Power has constructed a €123 billion backlog, representing 3.6x annual earnings, which supplies just right visibility into oversized natural earnings and profits enlargement. We estimate that Siemens Power’s profits energy will exceed €5 in line with proportion by means of the tip of the last decade.

Fairness Place Replace

PG&E Company (PCG)

We’re devastated by means of the new occasions in Southern California. A number of of our members of the family and workforce individuals name Los Angeles house, and our hearts are with all impacted by means of the fires.

Whilst PG&E does no longer function on this area, there may be press hypothesis that one of the most fires, Eaton, will have been associated with transmission apparatus owned by means of SoCal Edison (SCE), any other investor-owned application (guardian corporate Edison Global.) Edison has said publicly that they don’t consider their apparatus used to be concerned. The investigation is ongoing, and we consider it’s untimely to make conclusions in regards to the foundation of the hearth.

If the Eaton fireplace ignition used to be associated with SCE apparatus, the California felony usual of “inverse condemnation” exposes SCE to resultant belongings harm liabilities. After PG&E’s chapter in 2019, California handed a invoice referred to as AB1054 which protects the state’s investor-owned utilities (Edison, PG&E and Sempra) from those liabilities so long as they adhere to a rigorous protection usual. This features a complete wildfire mitigation plan authorised every year by means of the federal government and a dedication to spend billions to harden the grid; for instance, PG&E is spending a whopping $18 billion on wildfire mitigation from 2023-2025. In change, AB1054 comprises a number of protections, comparable to a felony prudency usual that entitles the application to price restoration by way of more than one avenues within the occasion of a catastrophic fireplace and a $21 billion insurance coverage fund to hide incurred liabilities. SCE has an lively protection certificates and thus must get pleasure from the protections beneath AB 1054, simply as PG&E would in case of a long run fireplace. Regulator-approved value restoration is a regimen continuing for utilities in spaces susceptible to critical local weather occasions (hurricanes, tornadoes, earthquakes, and so forth.) in acknowledgement of the truth that it isn’t possible to take away all menace from overhead grid infrastructure. PCG has been the preeminent suggest in California for undergrounding, which we consider is the one solution to completely get rid of wildfire menace from grid property.

PG&E is now buying and selling somewhat under 10x 2026 profits, as opposed to regulated application friends buying and selling above 15x. We observe that PG&E is buying and selling at kind of the similar more than one as Edison in spite of 0 direct monetary liabilities from the occasions in Los Angeles. We consider traders are overly discounting the monetary and felony protections supplied by means of AB 1054. We think extra readability from the state over the approaching weeks and months.

Company Credit score Replace

3rd Level’s company credit score ebook generated a 4.2% gross go back (3.8% web) right through the Fourth Quarter, contributing ~60 foundation issues to web efficiency. That outcome put 2024 efficiency at +13.0% gross (11.3% web), roughly +480 foundation issues forward of the ICE BofA US Top Yield Index. Our company credit score portfolio considerably outperformed within the Fourth Quarter due to a (regrettably, in hindsight) small place within the GSE most popular securities, in addition to sturdy efficiency in our broadband credit.

Whilst our company credit score ebook used to be up in December, the hawkish Federal Open Marketplace Committee statement that accompanied the speed minimize burdened menace property and ended in each greater charges and spreads. Charges loved a aid rally at the December CPI print, however 10-year Treasury yields (US10Y) stay above 4.5%, greater than 300 foundation issues upper than the 2020/21 moderate. As we now have discussed sooner than, we consider that the excessive yield Magnificence of 2020/21, which noticed document volumes of leverage buyouts financed at excessive valuations and document low yields, will face important credit score rigidity as their debt matures over the following couple of years. Whilst defaults were very low, we’re already seeing greater ranges of debt exchanges and wait for that this tempo will build up, particularly if rates of interest stay close to present ranges, let on my own transfer upper.

We consider Legal responsibility Control Workout routines, (LME’s) have grow to be probably the most attractive distressed credit score alternatives. LME’s contain an out of court docket change be offering the place a sponsor is looking for to cut back the important quantity of debt, cut back passion expense and/or prolong maturities. Whilst the objective (prolong the runway for the fairness, most likely prevent a big write down) and regulations of those exchanges (normally the “waterfall” of creditor precedence is attacked via covenant loopholes) are other from an in-court chapter, the funding alternatives are an identical. At the entrance finish, lively participation in an LME procedure can create new securities at very horny ranges. At the again finish, there may be every so often an excessively horny “post-LME” technical the place collectors are desperate to go out following the method for a number of causes. On a elementary degree, post-LME credit frequently have a strong capital construction, longer liquidity runways and higher covenant applications.

That stated, no longer all LME’s are true fixes. Whilst it’s rather uncommon to peer an organization (out of doors the ones in secular decline) go through chapter two times (the ignominious “Bankruptcy 22”), it’s attention-grabbing to notice that about 40% of credit that go through out-of-court exchanges in the long run document for chapter anyway. In consequence, credit score variety stays essential.

At the present we invested in 5 scenarios that experience passed through LME’s within the remaining yr. We’re invested in any other 8 that we wait for will go through LMEs within the subsequent six months. General, fresh, present and potential LME scenarios constitute virtually part of our present company credit score portfolio, or over $700 million. We think this house to be the most important supply of alpha within the coming months.

Structured Credit score Replace

In 2024, 3 main issues drove returns and we predict those identical traits will create attention-grabbing alternatives over the following 18 months. Even though the brand new Management continues to be formulating its insurance policies, deregulation is anticipated to be a key component, which we consider can be a favorable tailwind for structured credit score given the excessive regulatory capital fees for banks since 2009. Given structured credit score spreads are wider to each different asset magnificence, we wait for extra unfold compression in 2025. Those 3 issues are:

Charges and Mortgages: Regardless of the volatility in charges and converting expectancies of the Fed’s fee minimize plan, 5-year Treasuries rose 50 foundation issues in 2024. We wait for that charges will stay range-bound, making a excessive base fee for structured credit score property. We referred to as 5 unrated reperforming loan offers this yr, monetizing roughly 25% and refinancing into rated securitizations the place we bought AAAs via unmarried A. We now personal rated tranches with greater liquidity and possible upside for unfold period as insurance coverage firms search for rated property. Residential mortgages proceed to be a supply of power for the shopper, with debtors nonetheless conserving, on moderate, 50% fairness of their houses. We’re beginning to see the primary indicators of a slowdown in subprime, considered via client unsecured and subprime auto loans and feature diminished publicity in the ones sectors.

Securities vs. Loans: Whilst headlines in structured credit score this yr had been ruled by means of artificial menace switch (SRT) and portfolio gross sales, we enthusiastic about opportunistic trades like auto ABS and non-qualified loan BBs. We had been very lively in each mortgage purchases and SRT about 3 years in the past when gross IRR expectancies had been within the mid- to high-teens. Lately, we really feel that marketplace is crowded with marketed yields within the youth, however precise returns under 10%. Against this, we enthusiastic about producing alpha via secondary buying and selling. As extra fastened source of revenue strikes to each insurance coverage and personal credit score price range, we now have been in a position to supply, in our view, compelling risk-adjusted returns via lively buying and selling and offering liquidity when cash managers want it. Insurance coverage firms have spurred a technical bid up of loan loans this yr, however we’re discovering 100-200 foundation issues of wider unfold within the BB tranches with credit score give a boost to.

Credit score Unfold Tightening: Many traders have requested in fresh weeks about credit score unfold widening and what’s attention-grabbing at the present time. Whilst the funding grade company index is on the subject of all time tights within the mid-40s foundation issues, we consider structured credit score nonetheless has room to rally. For instance, residential mortgage-backed AAAs are between a 115-135 foundation level unfold in comparison to the historic tights in 2021 within the 60s.

Having a look to 2025, financial institution M&A job is anticipated to extend, which can most likely lead to extra banks promoting client and loan mortgage portfolios. We will be able to be opportunistic on smaller portfolios the place we predict to receives a commission a high-single digits unlevered yield at the loans being able to create mid-teens returns on our retained publicity.

Acquisition of Birch Grove

In overdue December, we introduced our aim to obtain 100% of AS Birch Grove, a various selection credit score fund supervisor with roughly $8 billion of AUM. The transaction is anticipated to near in mid-February. Birch Grove used to be based by means of President Andrew Fink and CEO and CIO Jonathan Berger — who will grow to be 3rd Level’s Co-Head of Credit score along Spouse Ian Wallace. Ian, Steve Schatzman, Shalini Sriram, and Chris Taylor will care for their present roles and paintings with Jonathan and me to increase new credit score merchandise reflecting the corporations’ complementary methods.

Birch Grove’s price range come with a well-established CLO industry with over $5 billion in AUM, a non-public credit score providing that enhances our present skillset, a credit score answers product, and several other different methods. Whilst Birch Grove and 3rd Level price range will proceed to be one at a time controlled by means of their long-tenured groups, we’re occupied with the features the Birch Grove acquisition will upload to the credit score efforts in the principle price range and to our devoted structured, company, and personal credit score choices.

We wait for important synergies between 3rd Level’s newly created non-public credit score effort and Birch Grove. We think that the CLO industry, enthusiastic about tradeable time period loans, will lend a hand each our structured and company credit score efforts by means of offering a window into over 400 leveraged loans that may function an early caution machine for possible stressed out and distressed alternatives. Our structured credit score effort actively trades CLO liabilities and Birch Grove will proceed to be an lively issuer of the ones liabilities, which we consider may give useful views on provide and pricing of the ones securities. Those are simply a number of the synergies we look forward to finding as the companies start nearer collaboration in an atmosphere the place shoppers are on the lookout for leading edge answers around the credit score spectrum. Our Industry Construction workforce might be satisfied to proportion alternatives in new credit score merchandise as they grow to be to be had within the coming months.

Industry Replace

Adiel Gopas joined 3rd Level Ventures, that specialize in investments in Israel. Earlier than becoming a member of 3rd Level Ventures, Mr. Gopas used to be Head of Company Construction and Technique at OpenWeb. In the past, Mr. Gopas used to be a part of the Funding Banking and Undertaking Capital funding efforts at Poalim Fairness, the funding arm of Financial institution Hapoalim, Israel’s biggest financial institution. Previous in his profession, he oversaw the Financial institution’s Fund of Price range portfolio of over 25 main challenge capital companies and performed an instrumental position in organising and sponsoring rising VC managers. Mr. Gopas holds a B.S. in Economics from Reichman College.

Sincerely,

Daniel S. Loeb CEO

The guidelines contained herein is being supplied to the traders in 3rd Level Traders Restricted (the “Corporate”), a feeder fund indexed at the London Inventory Alternate that invests considerably all of its property in 3rd Level Offshore Fund, Ltd (“3rd Level Offshore”). 3rd Level Offshore is controlled by means of 3rd Level LLC (“3rd Level” or “Funding Supervisor”), an SEC-registered funding adviser headquartered in New York. 3rd Level Offshore is a feeder fund to the 3rd Level Grasp Fund LP in a master-feeder construction. 3rd Level LLC , an SEC registered funding adviser, is the Funding Supervisor to the Price range.

Except another way specified, all data contained herein pertains to the 3rd Level Grasp Fund LP inclusive of legacy non-public investments. P&L and AUM data are offered on the feeder fund degree the place appropriate. Sector and geographic classes are made up our minds by means of 3rd Level in its sole discretion.

Efficiency effects are offered web of control charges, brokerage commissions, administrative bills, and amassed efficiency allocation, if any, and come with the reinvestment of all dividends, passion, and capital beneficial properties. Whilst efficiency allocations are amassed per month, they’re deducted from investor balances best every year or upon withdrawal. From the inception of 3rd Level Offshore via December 31, 2019, the fund’s historic efficiency has been calculated the usage of the true control charges and function allocations paid by means of the fund. The true control charges and function allocations paid by means of the fund replicate a combined fee of control charges and function allocations according to the weighted moderate of quantities invested in numerous proportion categories topic to other control commission and/or efficiency allocation phrases. Such control commission charges have ranged through the years from 1% to two% in line with annum. The volume of efficiency allocations appropriate to anybody investor within the fund will range materially relying on a lot of elements, together with with out limitation: the particular phrases, the date of preliminary funding, the period of funding, the date of withdrawal, and marketplace stipulations. As such, the online efficiency proven for 3rd Level Offshore from inception via December 31, 2019 isn’t an estimate of any particular investor’s precise efficiency. For the length starting January 1, 2020, the fund’s historic efficiency presentations indicative efficiency for a brand new problems eligible investor within the best control commission (2% in line with annum) and function allocation (20%) magnificence of the fund, who has participated in all aspect pocket non-public investments (as appropriate) from March 1, 2021 onward. The inception date for 3rd Level Offshore Fund Ltd is December 1, 1996. All efficiency effects are estimates and previous efficiency isn’t essentially indicative of long run effects.

The web P&L figures are integrated on account of the SEC’s new advertising and marketing rule and steerage. 3rd Level does no longer consider that this metric correctly displays web P&L for the referenced sub-portfolio workforce of investments as defined extra totally under. Particularly, web P&L returns replicate the allocation of the best control commission (2% in line with annum), along with leverage issue more than one, if appropriate, and incentive allocation fee (20%), and an assumed working expense ratio (0.3%), to the combination underlying positions within the referenced sub-portfolio workforce’s gross P&L. The control charges and working bills are allotted for the length proportionately according to the typical gross exposures of the combination underlying positions of the referenced sub-portfolio workforce. The implied incentive allocation is according to the deduction of the control commission and expense ratio from 3rd Level Offshore fund degree gross P&L attribution for the length. The motivation allocation is amassed for each and every length to simply the ones positions inside the referenced sub-portfolio workforce with i) sure P&L and ii) if right through the present MTD length there may be an incentive allocation. In MTD sessions the place there’s a reversal of in the past amassed incentive allocation, the have an effect on of the reversal might be according to the former month’s YTD amassed incentive allocation. The assumed working expense ratio famous herein is implemented uniformly throughout all underlying positions within the referenced sub-portfolio workforce given the inherent problem in figuring out and allocating the bills on a sub-portfolio workforce foundation. If bills had been to be allotted on a sub- portfolio workforce foundation, the online P&L would most likely be other for each and every referenced funding or sub-portfolio workforce, as appropriate.

Whilst the performances of the fund has been when put next right here with the efficiency of well known and widely known indices, the indices have no longer been decided on to constitute a suitable benchmark for the fund whose holdings, efficiency and volatility would possibly fluctuate considerably from the securities that include the indices. Previous efficiency isn’t essentially indicative of long run effects. All data supplied herein is for informational functions best and must no longer be deemed as a advice to shop for or promote securities. All investments contain menace together with the lack of important. This transmission is confidential and will not be redistributed with out the specific written consent of 3rd Level LLC and does no longer represent an be offering to promote or the solicitation of an be offering to buy any safety or funding product. Such a be offering or solicitation would possibly best be made by way of supply of an authorised confidential providing memorandum.

Explicit firms or securities proven on this presentation are supposed to exhibit 3rd Level’s funding taste and the kinds of industries and tools wherein we make investments and aren’t decided on according to previous efficiency. The analyses and conclusions of 3rd Level contained on this presentation come with positive statements, assumptions, estimates and projections that replicate quite a lot of assumptions by means of 3rd Level regarding expected effects which can be inherently topic to important financial, aggressive, and different uncertainties and

contingencies and feature been integrated only for illustrative functions. No representations categorical or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with recognize to some other fabrics herein. 3rd Level would possibly purchase, promote, duvet, or another way alternate the character, shape, or quantity of its investments, together with any investments recognized on this letter, with out additional realize and in 3rd Level’s sole discretion and for any reason why. 3rd Level hereby disclaims any accountability to replace any data on this letter.

This letter would possibly come with efficiency and different place data in terms of as soon as activist positions which can be now not lively however for which there stay residual holdings controlled in a non-engaged approach. Such holdings would possibly proceed to be labeled as activist right through such conserving length for portfolio control, menace control and investor reporting functions, amongst different issues.

Knowledge supplied herein, or another way supplied with recognize to a possible funding within the Price range, would possibly represent personal data referring to 3rd Level Traders Restricted, a feeder fund indexed at the London Inventory Alternate, and accordingly dealing or buying and selling within the stocks of the indexed software at the foundation of such data would possibly violate securities regulations in the UK, United States and somewhere else.

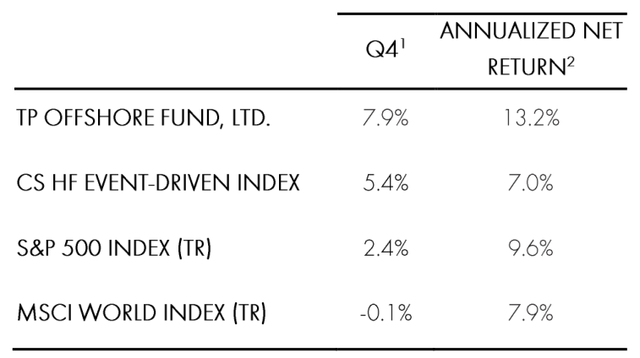

New Collection (Excludes Legacy Personal Investments)3

1Through December 31, 2024.

2Annualized Go back from inception (December 1996 for TP Offshore and quoted indices).

3“New Collection (Excludes Legacy Personal Investments)” makes use of the prevailing sequence observe document shape inception via Would possibly 31, 2023.

Returns from June 1, 2023 and onward exclude legacy non-public investments.

Click on to amplify

Editor’s Be aware: The abstract bullets for this newsletter had been selected by means of In quest of Alpha editors.

Editor’s Be aware: This text discusses a number of securities that don’t business on a big U.S. change. Please pay attention to the hazards related to those shares.