Listed below are 3 of Berkshire Hathaway’s favourite shares.

In unsure markets, it can pay to observe confirmed knowledge — and few buyers have a monitor document as mythical as Warren Buffett. Since taking up Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) in 1965, Buffett has weathered each and every marketplace typhoon and persistently outperformed marketplace benchmarks. Due to regulatory filings, buyers get a quarterly glance within Berkshire’s massive portfolio — a unprecedented window into the tactic of certainly one of historical past’s maximum a hit buyers.

With that during thoughts, 3 of Berkshire’s biggest holdings stand out as sensible buys nowadays.

1. American Specific

American Specific (AXP -0.54%) is a favourite Buffett inventory, and Berkshire hasn’t bought a unmarried percentage because it finished its $1.3 billion funding in 1995 for more or less 10% of the monetary products and services corporate.

As of late, the inventory trades at about $250 in step with percentage, down 15% in 2025, and can pay a quarterly dividend of $0.82 in step with percentage, representing an annual yield of one.3%. Even if the corporate does not carry its dividend annually, it has a protracted historical past of will increase, together with 4 consecutive years of expansion.

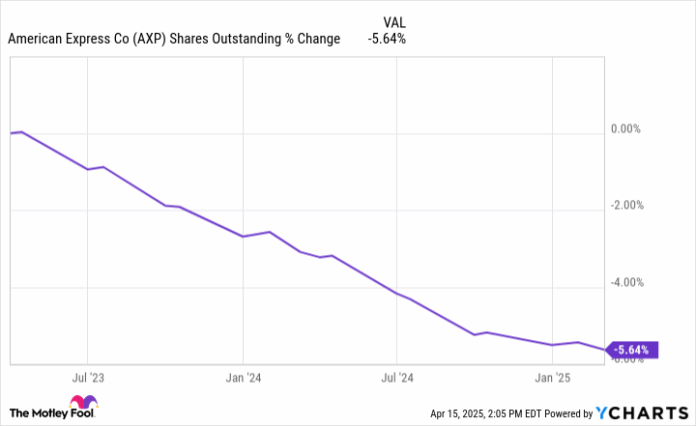

The corporate could also be in the course of a 120 million percentage repurchase plan, which used to be introduced in March 2023, and has already diminished its percentage depend from 744 million to 701 million, or more or less 5.6%. On account of a long time of inventory buybacks, Berkshire’s stake has soared to 21.6% with out purchasing a unmarried percentage since 1995.

Past its dividend and percentage repurchases, American Specific delivered document income in 2024, up 10% 12 months over 12 months to $65.9 billion. With that income, the corporate — which operates as a closed-loop community through issuing playing cards, extending credit score to card customers, and keeping the loans on its books — generated $10.1 billion in web source of revenue, a year-over-year build up of 21%.

As for dangers, in a closed-loop community, American Specific is liable to defaults, that are on the upward push. To account for anticipated unrecoverable losses, it data non-cash provisions for credit score losses. In 2024, provisions totaled $5.2 billion with a web write-off price of two%, up from $4.9 billion and 1.8% in 2023.

As of late, American Specific stocks business at a price-to-earnings (P/E) ratio of about 18, which aligns with its five-year median, suggesting that it is somewhat valued.

AXP Shares Outstanding information through YCharts

2. DaVita

Berkshire Hathaway owns a 44% stake in the second one inventory in this record, DaVita (DVA -0.91%), a healthcare corporate that has lately shifted from only a dialysis supplier to providing extra complete kidney care products and services. It recently serves about 281,000 sufferers. DaVita’s inventory trades for roughly $140 in step with percentage in 2025, down about 6% for the 12 months and about 22% under its all-time top. The drop may also be attributed to a contemporary ransomware assault, which has affected a few of its operations.

In 2024, the corporate accomplished document monetary effects, producing $12.8 billion in income and $2.1 billion in running source of revenue, representing year-over-year expansion of five.6% and 30.4%, respectively.

Regardless of its robust efficiency, DaVita faces some power at the steadiness sheet. The corporate holds $8.6 billion in web debt, in comparison to its $11.2 billion marketplace capitalization. Nonetheless, with its unfastened coins circulation of $1.2 billion in 2024, control may just pay it down if it chooses. As a substitute, control is aggressively purchasing again its inventory, decreasing its stocks remarkable through 34% all over the previous 5 years, suggesting it believes the corporate is undervalued, because it trades at a price-to-free-cash-flow ratio of seven.9.

In the longer term, DaVita’s subsequent expansion section will most probably hinge on increasing its international footprint. As of the tip of 2024, 84% of its 3,166 outpatient facilities have been based totally within the U.S. The corporate is actively pursuing global alternatives, lately increasing into Colombia and looking forward to regulatory popularity of a pending deal in Brazil, anticipated through midyear.

DVA Shares Outstanding information through YCharts

3. Kroger

Berkshire Hathaway has constructed up a just about 8% place in Kroger (KR 3.32%) since its first acquire in 2019. The main operator of grocery retail outlets within the U.S. is a outstanding dividend-paying inventory, having paid and raised its dividend for 19 consecutive years. It recently gives a quarterly dividend of $0.32 in step with percentage, translating to an annual yield of about 1.8%.

Whilst Kroger is not recognized for top income expansion, it stays a gentle performer. In 2024, general gross sales reached $147.1 billion, up 1.8% from 2023, apart from particular pharmacy gross sales, gasoline, and an additional 53rd week. Extra significantly, the corporate advanced its profitability, posting $3.8 billion in running benefit — a 31% build up from the prior 12 months, once more adjusting for the 53rd week.

What actually sticks out, alternatively, is Kroger’s competitive buyback process. All through the previous 12 months, the corporate has repurchased 9% of its stocks remarkable. This transfer used to be basically fueled through the cave in of its proposed acquisition of Albertsons Firms, which the Federal Industry Fee antagonistic.

With that deal off the desk, Kroger redirected its capital to shareholders. In December 2024, control introduced an speeded up $5 billion percentage repurchase program, with any other $2.5 billion earmarked for buybacks as soon as this is entire.

Relating to valuation, Kroger stocks business at 19.4 occasions trailing revenue — above their three-year median of 16.1 — indicating a possible top rate. Nonetheless, for long-term buyers, Kroger represents a strong, market-dominant grocery chain involved in returning capital to shareholders thru dividends and inventory buybacks.

KR Shares Outstanding information through YCharts

Are those Buffett shares value purchasing?

Those shares don’t seem to be handiest key holdings in Berkshire Hathaway’s portfolio — in addition they percentage any other vital trait: each and every corporate is aggressively purchasing again its stocks. As Buffett as soon as defined, “The mathematics is not sophisticated: When the proportion depend is going down, your pastime in our many companies is going up. Each and every small bit is helping if repurchases are made at value-accretive costs.”

For long-term buyers taking a look to possess marketplace leaders and prioritize returning capital to shareholders, those Buffett-backed corporations are worthy additions for your portfolio.