Even if development shares have a spot in lots of portfolios, even younger, risk-tolerant buyers must personal some long-term worth shares. Those shares that you’ll depend on provide the flexibility to speculate a few of your different price range in higher-risk, higher-growth doable shares, since they decrease the whole threat of all of your portfolio.

American Categorical (AXP -1.20%) has been round since 1850 — that is rather a monitor report of luck. It is a most sensible inventory with a differentiated type and long-term development drivers, and it provides balance for any more or less investor. Listed here are 3 causes to shop for it now and dangle it for a minimum of 5 years.

1. The resilient client base

American Categorical has created a emblem that goals the prosperous client, and this buyer base is extra resilient than the common individual. That gives some safety for American Categorical, and it has persisted to file wholesome, successful development in spite of the inflationary atmosphere. Earnings larger 10% yr over yr (forex impartial) in 2024, and profits in keeping with proportion have been up 25% to $14.01. CEO Stephen Squeri famous that momentum larger towards the tip of the yr with a robust vacation season.

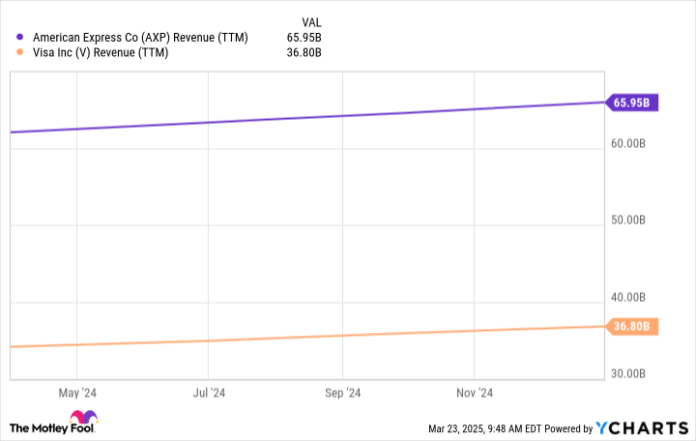

Imagine that despite the fact that American Categorical has just a fraction of competitor Visa’s playing cards (153 million as opposed to greater than 2.9 billion for Visa), it takes in on the subject of double Visa’s income.

AXP Revenue (TTM) knowledge via YCharts.

Nowadays, it is attaining a more youthful client base. It has long past via a picture overhaul and is continuously refreshing its playing cards and rewards program to attraction to the fashionable cardmember, and more youthful individuals account for extra of its spending than every other age staff. Control mentioned U.S. fee-based client top rate playing cards are the fastest-growing section in its business, and that it has 25% of the ones playing cards, implying numerous upside doable. Millennial and Gen Z consumers are the fastest-growing age staff in those playing cards, and American Categorical is including them at a better price than the whole business.

American Categorical additionally acts as its personal financial institution, offering it with various income streams and a streamlined operational type. More youthful consumers are using development right here too, with millennial and Gen Z individuals accounting for part of the high-yield financial savings accounts and a 3rd of general balances.

2. The cost-based type

A method American Categorical sticks out is that it fees charges for plenty of of its bank cards. That creates loyalty and a ordinary income circulate, and card charges develop at double-digit charges once a year — 16% in 2024, accounting for just about 13% of general income. About 70% of latest card acquisitions have been for fee-based playing cards, and control expects commission development to stick within the mid- to excessive teenagers in 2025. It additionally has excessive renewal charges, feeding into this cycle.

Squeri identified that the U.S. client gold card, which is its gold-standard and has a $325 annual commission, is resonating with a more youthful buyer base. This club base will force long run development for American Categorical.

3. The dividend

American Categorical will pay a increasing dividend that yields simply over 1% on the present worth, or about its reasonable. The dividend is crucial reason why that Warren Buffett is one of these fan, even supposing he loves the entire package deal. American Categorical has paid a dividend since 1989,and it is larger greater than 200% during the last 10 years. It simply introduced a 17% building up, from $0.70 to $0.82. That is a very good indication of ways control feels in regards to the corporate’s place and energy.

American Categorical is a inventory you’ll purchase as of late and dangle for years, taking advantage of its function within the economic system and passive source of revenue.

American Categorical is an promoting spouse of Motley Idiot Cash. Jennifer Saibil has positions in American Categorical. The Motley Idiot has positions in and recommends Visa. The Motley Idiot has a disclosure coverage.