If you have got a pile of money burning a hollow to your pocket, believe placing it to paintings within the inventory marketplace. Lengthy-term making an investment is an effective way to construct wealth, and few know this higher than making an investment legend Warren Buffett, who has became his once-modest preserving corporate, Berkshire Hathaway (BRK.A 2.54%) (BRK.B 2.79%), right into a $1.1 trillion fairness behemoth.

Beneath I will talk about why Chinese language electric-vehicle (EV) maker BYD (BYDDY 7.09%) — in addition to stocks in Berkshire Hathaway itself — might be nice buys at this time.

BYD

Since its 2003 founding in Shenzhen, China, BYD has been using the wave of China’s commercial miracle. It beginning as a battery production and electronics corporate earlier than pivoting to electrical automobiles a couple of years later. Warren Buffett started purchasing stocks in 2008 and now owns a considerable $2.5 billion price of BYD fairness, representing about 1% of Berkshire’s general portfolio.

It is simple to peer why he likes the corporate. Buffett has a tendency to prefer companies with deep financial moats, which refers back to the aggressive merit they’ve over trade competitors. In BYD’s case, the moat is the corporate’s vertical integration because it manufactures its personal batteries at scale, enabling it to cross on value financial savings to shoppers.

Then again, BYD is not just about low costs. The corporate has began to emerge as a technological chief.

In March, it unveiled a brand new generation able to charging EVs in simply 5 mins, offering as much as 249 miles of vary. If this makes it into mass manufacturing, it would considerably shut the ease hole between electrical vehicles and their gasoline-powered opposite numbers.

BYD’s valuation could also be too excellent to forget about. With a ahead price-to-earnings ratio (P/E) of simply 19.5, the stocks are considerably less expensive than rival Tesla, which business at a ahead P/E of 84. Fourth-quarter benefit jumped by way of an excellent 73% 12 months over 12 months to $2.1 billion.

Berkshire Hathaway

As an alternative of shopping for particular person shares, some buyers might wish to guess on all the Berkshire portfolio. This transfer would allow better diversification throughout quite a lot of industries whilst leveraging Warren Buffett’s holistic technique and market-beating instincts.

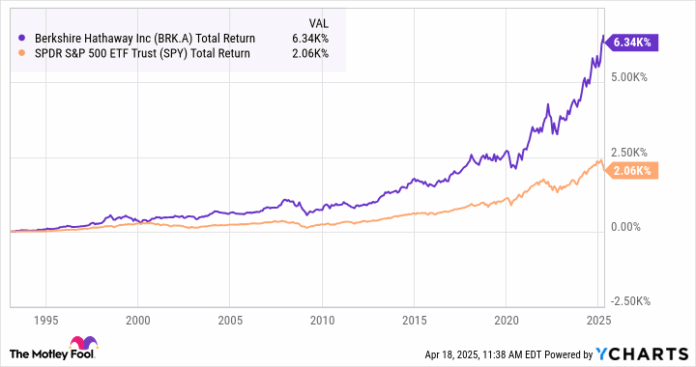

Buffett has famously mentioned, “By no means guess in opposition to The us,” referencing the rustic’s super industry doable, even within the face of brief setbacks. With multibillion-dollar positions in main U.S. firms like Apple, Coca-Cola, and American Specific, the Oracle of Omaha places his cash the place his mouth is. And on the subject of efficiency, Berkshire Hathaway has constantly overwhelmed the S&P 500.

BRK.A Total Return Level information by way of YCharts.

Berkshire’s edge might come from its talent to answer adjustments within the macroeconomic panorama. In 2024, the preserving corporate started elevating eyebrows by way of promoting inventory and no longer reinvesting, finishing the 12 months with $334.2 billion in money. Some analysts assume this transfer can have been in anticipation of the tariff-led sell-off this 12 months. Berkshire Hathaway is able to scoop up high quality shares for inexpensive when the mud settles.

Traders should not be expecting Berkshire Hathaway to copy the explosive expansion it has skilled all through previous a long time. The bigger a portfolio is, the tougher it turns into to develop. That stated, the mythical preserving corporate appears absolutely able to keeping up its market-beating good fortune.

Which inventory is right for you?

BYD and Berkshire Hathaway are each superb possible choices in line with Warren Buffett’s a success making an investment technique. That stated, buyers who prioritize market-trouncing expansion must glance to BYD, because of its large alternative to scale its EV industry globally. Berkshire Hathaway is some other superb selection, however its measurement and diversification make its efficiency extra intently align with the S&P 500 reasonable.

American Specific is an promoting spouse of Motley Idiot Cash. Will Ebiefung has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Apple and Berkshire Hathaway. The Motley Idiot recommends BYD Corporate. The Motley Idiot has a disclosure coverage.