It is laborious to expect which means the marketplace, or any particular corporate, will transfer in a brief duration, like a unmarried 12 months. However the longer we amplify our horizon, the much more likely it’s that very good corporations, and equities on the whole, will ship forged returns. That is one of the most causes (along side tax benefits) that long-term making an investment is a smart technique.

Alternatively, this all hinges on which shares you select to shop for — hanging your hard earned cash into subpar corporations may not lead to sexy long-term returns. That mentioned, let’s believe two extremely winning companies that glance value making an investment in for just right: Intuitive Surgical (ISRG 0.19%) and Visa (V -0.19%).

1. Intuitive Surgical

Since hospital therapy is at all times in top call for, cutting edge healthcare corporations that may stay alongside of the adjustments within the trade can carry out properly over lengthy classes. That describes Intuitive Surgical beautiful properly.

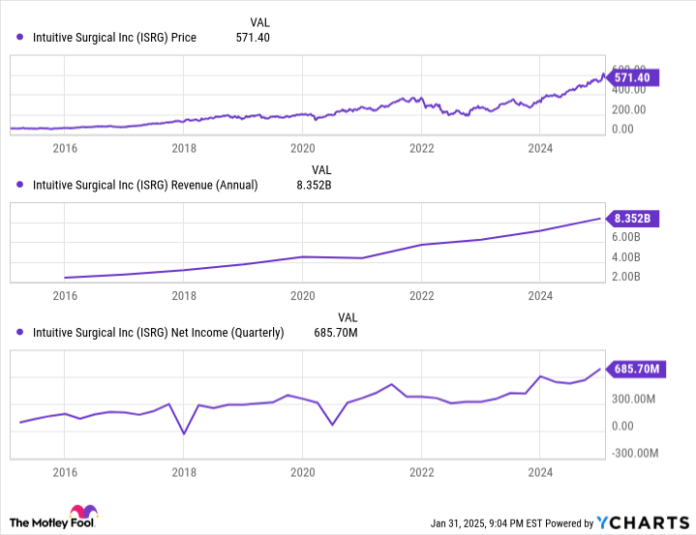

The corporate leads the robotic-assisted surgical procedure (RAS) software marketplace due to its da Vinci gadget. Intuitive Surgical is an innovator; it was once one of the most first corporations to earn clearance for an RAS gadget within the U.S., and has since evolved a number of extra iterations of its crown jewel. The greater adoption of robot surgical procedure has allowed the healthcare chief to generate very good monetary effects and awesome stock-market efficiency.

Why, although, must traders stay the inventory of their portfolios for just right? There are no less than two causes.

First, there is nonetheless considerable white area within the RAS marketplace, which Intuitive Surgical leads. But even so the truth that call for for most of the procedures physicians can carry out with the da Vinci gadget will build up as the arena inhabitants ages, robot surgical procedures accounted for not up to 5% of general eligible surgical procedures as of 2 years in the past. It will take many years prior to this quantity peaks, whilst extra corporations sign up for the trade.

That brings us to our 2d explanation why Intuitive Surgical’s inventory is value maintaining onto endlessly: the corporate’s moat, an crucial factor for any trade searching for long-term luck. Intuitive’s aggressive merit stems from more than one resources, together with its many patents for novel creations, and the top switching prices concerned as soon as a health center gadget has already bought considered one of its da Vinci merchandise.

So whilst the sector will get extra crowded — which can take some time, taking into consideration the trouble of establishing and checking out robot platforms — Intuitive Surgical must proceed to accomplish properly for a very long time. The scientific software specialist looks as if a inventory traders can safely purchase and disregard.

2. Visa

We all know Visa, the monetary services and products specialist that is helping facilitate bank card transactions via its cost community. Tens of millions of bank cards are in move branded with the corporate’s well-known brand, and Visa collects a charge each and every time a client makes use of a type of bank cards. That is not a foul trade type, taking into consideration the choice of day by day transactions.

Visa’s enlargement up to now decade has been pushed via an build up in bank card transactions, which can be displacing money and tests. Bank cards are more straightforward and extra handy to hold than huge quantities of money. They are additionally, most often talking, more secure to carry. Moreover, bank cards cater to each on-line and in-person transactions, the most important issue given the expansion of e-commerce. So it is not sudden that Visa has been an ideal inventory to possess during the last decade:

Like several shares worthy of maintaining directly to for just right, Visa advantages from a aggressive edge, and it is not simply the corporate’s sturdy logo identify.

Its cost community is a textbook case of the community impact. The extra that customers hang playing cards bearing its brand, the extra sexy it turns into to traders, and vice versa. Now not accepting a Visa card in puts the place the corporate is well-established may quantity to turning down a ton of customers, one thing huge and a hit companies most often do not need to do.

Visa’s community impact in large part explains why it has so few direct competition; the trade is almost a duopoly. And whilst the corporate has grown impulsively lately, there’s nonetheless various white area. Alfred Kelly, Visa’s former CEO, mentioned this a couple of years in the past:

Whilst money displacement is for sure a truth, international private intake expenditure of money and test grew at a CAGR [compound annual growth rate] of two% over the ten years finishing in 2019. After we have a look at the chance forward, in the event you suppose international money grows at 1% yearly, industrywide virtual penetration of private intake expenditure would not succeed in 90% for a number of many years.

This paints fairly the image, with a transparent message: Visa can proceed rising for a very long time. This is one ultimate explanation why to spend money on the inventory: It is a very good dividend payer. During the last decade, Visa has greater its payouts via virtually 392%. Those that reinvest the dividend may just see oversized returns over the long term.