“Magnificent Seven” individuals Alphabet and Meta Platforms face antitrust movements that experience punished their stocks, however the drama seems to have created a purchasing alternative.

Heavy is the pinnacle that wears the crown. Alphabet (GOOGL 1.70%) (GOOG 1.52%), the mother or father of Google, and Meta Platforms (META 2.65%), previously referred to as Fb, are dealing with antitrust litigation in regards to the techniques they have got maintained their dominance in web seek and social media.

Traders normally dislike uncertainty, and amid a macroeconomic atmosphere that has turn out to be some distance much less predictable during the last few months, all of the marketplace has turn out to be more and more unstable. Between that and the company-specific dangers they face, Alphabet had fallen by means of 27% from its top and Meta Platforms had misplaced 32%, as of April 22.

The possible results of the circumstances in opposition to the ones firms may come with regulators forcing them to promote or spin off key trade belongings. That stated, shying clear of those most sensible synthetic intelligence (AI) firms now may turn out to be a mistake for buyers.

This is why buyers would possibly need to purchase this dip on Alphabet and Meta Platforms.

Era empires would possibly shrink

Alphabet and Meta Platforms are a number of the international’s maximum robust generation leaders. Every generates billions of greenbacks in annual advert income from its core companies. Alphabet dominates the web with its Google seek engine and device ecosystem, whilst Meta’s social media apps, together with Fb, Instagram, WhatsApp, and Threads, jointly succeed in 3.35 billion day-to-day energetic customers.

On the other hand, antitrust regulators have stepped in because of the ones firms’ strangleholds on their respective niches throughout the tech sector.

Alphabet has already misplaced two antitrust circumstances, one involving Google Seek and some other in the case of its anticompetitive practices in web advertising. Now, Alphabet and regulators will argue in court docket, and judges will decide what movements Alphabet would possibly want to take to treatment its violations. Alphabet is also ordered to promote its Chrome internet browser, or to stop paying Apple the billions of greenbacks a yr it spends within the deal that has made Google the default seek engine on iPhones’ Safari internet browser.

In the meantime, the Federal Industry Fee’s antitrust case in opposition to Meta Platforms over its competitive ways to both achieve opponents like Instagram and WhatsApp or do away with them is simply beginning. If the corporate loses, some speculate that it can be ordered to spin off or promote the ones apps.

Antitrust treatments is probably not that sour

The speculation of a breakup is frightening, however buyers may well be overreacting to the headlines. Each firms have layered a couple of services to construct generation ecosystems with robust community results.

Assume the courts blocked Alphabet from paying Apple for seek engine placement on its Safari internet browser.

Now, Alphabet determined it was once value paying tens of billions a yr to make Google the default seek engine in Apple’s Safari browser. Nonetheless, it’s not going that Google Seek would cave in if that association had been to finish. Safari is only one of Google’s many distribution channels, and has just a 17.5% proportion of the arena’s internet browser marketplace.

Google’s Chrome is the worldwide chief, with a 66% proportion. Even though Alphabet had been to promote or spin off Chrome, it’s tightly built-in with Google’s productiveness apps, similar to Gmail and others. In different phrases, it could be tricky to do away with the community results Alphabet advantages from until regulators dismantle the corporate. That turns out not going given how difficult it could be. In the meantime, the Chrome unit by itself may fight to generate income with out its Google connection, as it is a unfastened product.

The placement round Meta is slightly trickier as a result of there don’t seem to be as many layers to its ecosystem. If it needed to promote Instagram, WhatsApp, or each, that will be a large blow to its empire. The excellent news is that whilst Meta has leveraged its circle of relatives of apps to spice up each and every different, similar to by means of letting customers cross-post from Instagram and Fb to Threads, the large 3 apps — Fb, Instagram, and WhatsApp — nonetheless serve as independently of one another.

Due to this fact, Meta dropping one would not essentially diminish the others. A derivative would depart Meta smaller, however may additionally free up shareholder worth if an impartial, publicly traded Instagram or WhatsApp flourishes.

The antitrust dangers are actual, however buyers mustn’t panic. There’s no rush to behave, particularly when each and every corporation’s AI efforts would possibly create new core companies down the street.

Either one of those AI shares are higher bargains now

The AI development may one day be the extra essential catalyst for each firms, and that turns out not going to modify without reference to how issues prove with those antitrust circumstances. Mavens similar to the ones at PwC consider AI generation may create a multitrillion-dollar financial alternative over the following decade and past.

Alphabet’s AI alternatives come with:

AI-fueled development within the cloud;

An increasing self reliant ride-hailing trade in Waymo;

Quantum computing building;

Aggressive AI fashions (Gemini) for shoppers and enterprises.

Meta does not personal a public cloud platform, nevertheless it does have:

A broadening {hardware} trade with Meta Quest headsets and AI good glasses;

An open-source AI fashion (Llama) with over 1 billion downloads;

AI integrations all through its social media apps and current advert trade.

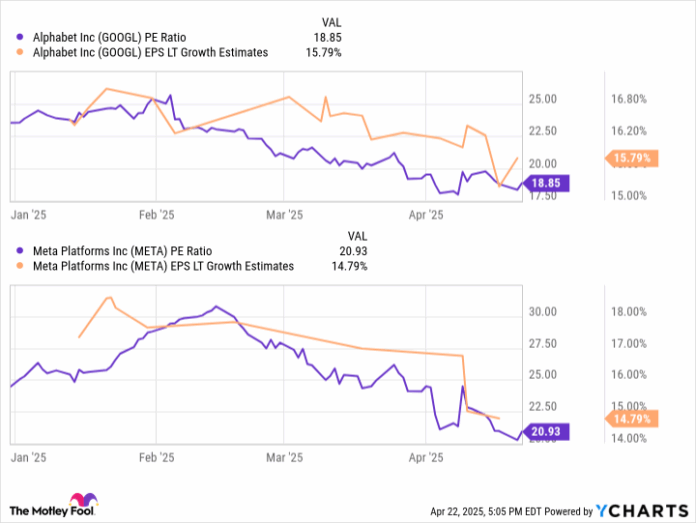

The dips in those shares have left them buying and selling at quite compelling valuations. Alphabet trades at a value/earnings-to-growth (PEG) ratio of simply 1.2, and Meta’s is 1.4. True, the normally agreed upon view is {that a} inventory is rather valued with a PEG ratio of one, and decrease is best. And certain, there are some possible dangers to be cautious about with either one of those tech giants. However would an investor be at an advantage purchasing stocks of Walmart, a mature trade buying and selling at nearly 40 instances revenue and at a PEG ratio of five.1? I do not be expecting Walmart’s inventory to outperform both Alphabet or Meta Platforms over the following 5 years until there’s a dramatic decline within the tech firms’ development and aggressive benefits.

GOOGL PE Ratio knowledge by means of YCharts.

It may be simple to get overanxious about funding dangers when the markets are already shaky. On the other hand, within the circumstances of Meta Platforms and Alphabet, it is method too early to panic about what those antitrust circumstances may imply, or even competitive court-mandated treatments may receive advantages shareholders. With that during thoughts, I would counsel tuning out the noise and taking a long-term view on two of the arena’s maximum robust generation firms.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of marketplace building and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Alphabet, Apple, Meta Platforms, and Walmart. The Motley Idiot has a disclosure coverage.