Those firms profit from the rising adoption of AI {hardware} and device.

The previous couple of years were completely extra special for era shares, which is obvious from the 90% features clocked by means of the Nasdaq-100 Era Sector index all through this era, and synthetic intelligence (AI) is among the major causes at the back of this exceptional surge.

Finally, AI has created important call for for {hardware} corresponding to semiconductors and server elements, whilst additionally growing the desire for device that may be deployed in real-world scenarios to lend a hand customers spice up their productiveness and make stronger potency. Extra particularly, the call for for AI {hardware} is forecast to extend at an annual price of 31% thru 2035, producing $624 billion in annual income.

In the meantime, the AI device marketplace is predicted to clock a compound annual expansion price of virtually 34% over the following 5 years. That is the reason why we will be able to take a more in-depth take a look at the AI-related potentialities of Taiwan Semiconductor Production (TSM 4.12%), popularly referred to as TSMC, and Twilio (TWLO 2.34%), two firms that may lend a hand traders profit from the rising call for for each AI {hardware} and device.

1. Taiwan Semiconductor Production

Semiconductors play a important position within the proliferation of AI, with AI fashions being educated the use of chips corresponding to graphics processing devices (GPUs), central processing devices (CPUs), and application-specific built-in circuits (ASICs). This is why why the likes of Nvidia, Complicated Micro Gadgets, Broadcom, and Marvell Era are seeing powerful call for for his or her chips.

The typical hyperlink between those firms is TSMC. The semiconductor firms discussed above are fabless in nature, because of this that they just design their chips whilst production is outsourced to a foundry corresponding to TSMC. Because of this, TSMC reported an ideal acceleration in its expansion this 12 months.

The Taiwan-based foundry large’s income within the first 9 months of 2024 larger by means of 32% 12 months over 12 months. For the entire 12 months, TSMC control expects income to extend by means of nearly 30%. That will translate right into a best line of $90 billion in line with the corporate’s 2023 income of $69.3 billion. It’s price noting that TSMC’s income gotten smaller nearly 9% closing 12 months as the corporate struggled because of deficient call for for smartphones and private computer systems (PCs).

Alternatively, the coming of a brand new catalyst within the type of AI has grew to become round TSMC’s fortunes remarkably in 2024, which is obvious from the spectacular expansion it has clocked within the first 9 months of the 12 months. That is not unexpected, because the call for for AI chips has merely taken off, with Long run Marketplace Insights estimating that this marketplace may just clock an annual expansion price of 26% over the following decade.

This places TSMC in an ideal place to clock powerful expansion for future years taking into consideration that it manufactures chips for the key gamers on this marketplace. Additionally, TSMC is the arena’s main foundry with a marketplace percentage of 62%, in step with Counterpoint Analysis. This additional reinforces the truth that the corporate is about to play the most important position within the expansion of the AI chip marketplace ultimately.

Alternatively, this is not the place TSMC’s AI-related potentialities finish. The corporate additionally manufactures chips for shopper gadgets corresponding to smartphones and PCs. AMD, Apple, and Qualcomm use TSMC’s fabrication crops for production chips for his or her merchandise. With the call for for AI-enabled smartphones and PCs set to take off, this would develop into any other profitable expansion motive force for TSMC.

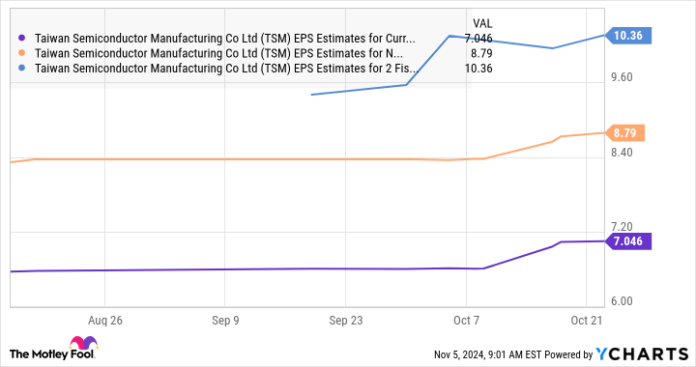

All this explains why analysts are forecasting TSMC to clock wholesome profits expansion transferring ahead.

TSM EPS Estimates for Current Fiscal Year information by means of YCharts

Extra importantly, traders should purchase this inventory at a good looking 21 instances ahead profits at the moment, which is a bargain to the Nasdaq-100 index’s ahead profits a couple of of 30 (the use of the index as a proxy for tech shares). So, traders having a look so as to add an AI inventory to their portfolios in November must certainly take a more in-depth take a look at TSMC because it has the possible to ship extra upside.

2. Twilio

Twilio operates within the communications platform-as-a-service (CPaaS) marketplace, providing utility programming interfaces (APIs) to consumers, during which they are able to connect to their consumers thru a couple of channels corresponding to voice, video, chat, electronic mail, and others. The corporate additionally supplies a buyer information platform during which it creates a centralized database containing the entire interactions an organization has with its consumers.

Twilio is now the use of AI to lend a hand its shoppers make stronger their customer support revel in in addition to gross sales by means of combining its experience in communications with buyer information. The corporate identified on its newest profits convention name that it’s “embedding AI and gadget studying all over the Twilio platform,” a transfer that it says will permit it to “automate functions, spice up productiveness, and power personalization at scale.”

Control added that consumers who’ve began the use of Twilio’s AI equipment noticed an development of their gross sales efficiency. CEO Khozema Shipchandler mentioned at the profits name:

The corporate lately ran an electronic mail marketing campaign focused on consumers perhaps to buy Apple merchandise and noticed a 592% build up in gross sales in line with electronic mail, that is simply one of the vital many examples of the original price that Twilio provides, serving to manufacturers create higher engagement, ship higher price and construct extra relied on buyer studies.

The adoption of AI equipment by means of Twilio consumers is now using an development within the corporate’s gross sales. It reported third-quarter income expansion of 10% 12 months over 12 months to $1.13 billion, a pleasing development over the 5% year-over-year expansion it recorded in the similar quarter closing 12 months. Even higher, Twilio’s addition of AI equipment to its platform is encouraging consumers to spend more cash.

That is obtrusive from its dollar-based internet enlargement price of 105% for the 0.33 quarter, which used to be once more an development over the year-ago duration’s studying of 101%. A dollar-based internet enlargement price of over 100% signifies that Twilio’s current consumers larger their utilization of the corporate’s answers, or followed extra of its choices. That is as a result of this metric compares the spending by means of Twilio’s consumers in 1 / 4 to the spending by means of the similar set of consumers within the year-ago duration.

The enhanced buyer spending and Twilio’s center of attention on preserving prices in take a look at are the the explanation why its profits larger at an excellent price of 76% from the similar duration closing 12 months to $1.02 in line with percentage within the earlier quarter.

Consensus estimates be expecting Twilio’s profits to extend at an annual price of virtually 20% for the following 5 years, because of this that its final analysis may just hit $6.09 in line with percentage in 2028 (the use of 2023 profits of $2.45 in line with percentage as the bottom).

Assuming it could possibly hit that mark over the following 5 years and trades (at the moment) in step with the Nasdaq-100 index’s ahead profits a couple of of 30, its inventory value may just hit $183. That will be a 110% build up from present ranges.

Twilio these days trades at simply 22 instances ahead profits, because of this that it’s attractively valued. Buyers have a possibility to shop for it ahead of it surges upper following its newest quarterly file.