Because the sports activities having a bet business explodes, DraftKings has established itself as one of the most premier platforms.

Like quite a lot of different more youthful enlargement shares, on-line sports activities having a bet corporate DraftKings (DKNG 1.05%) has skilled its justifiable share of ups and downs since going public in April 2020. After attaining an all-time top in March 2021, the inventory has misplaced simply over part of its worth.

Whilst there are many demanding situations and hurdles that DraftKings will want to iron out (at the side of the remainder of the sports-betting business), there may be quite a lot of long-term enlargement possible forward.

DraftKings isn’t just a sports activities having a bet corporate

DraftKings got here to prominence on account of its day by day fable and sports activities having a bet, nevertheless it has been making intentional efforts (principally thru acquisitions) to make bigger into different markets.

In 2022, it obtained Golden Nugget On-line Gaming to pick out up steam within the iGaming business, and the deal has been paying off since then. In a contemporary learn about by way of analysis corporate Eilers & Krejcik Gaming, DraftKings and Golden Nugget’s gaming apps had been ranked No. 1 and No. 2 total, respectively.

DraftKings additionally obtained the virtual lottery platform Jackpocket this 12 months to faucet into the rising lottery business. The corporate says it expects Jackpocket’s integration to give a contribution sure profits earlier than hobby, taxes, depreciation, and amortization (EBITDA) in 2025.

Going past sports activities having a bet permits DraftKings to cut back chance by way of turning into much less reliant on a unmarried marketplace whilst additionally increasing its buyer base. The latter additionally permits DraftKings to cross-sell its more than a few merchandise and decrease its buyer acquisition prices, that have been down 40% 12 months over 12 months in the second one quarter.

The trail to profitability is having a look clearer

Whilst DraftKings has been curious about taking pictures marketplace percentage, profitability has taken a again seat. Then again, fresh traits point out DraftKings will have to be winning by way of normally permitted accounting ideas (GAAP) requirements for the total 12 months in 2025.

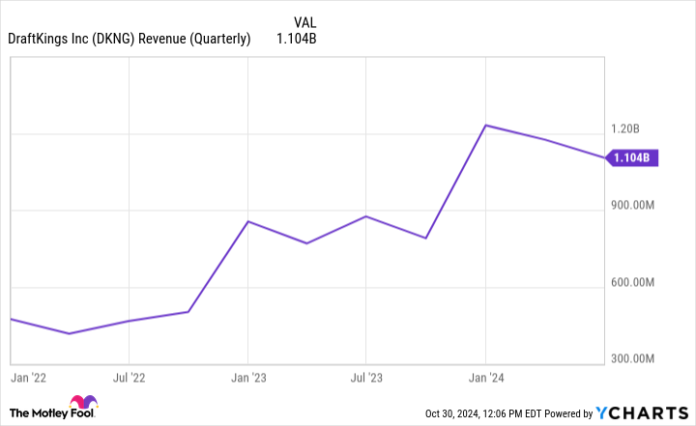

In the second one quarter, DraftKings generated $1.1 billion in income, up 26% 12 months over 12 months. The a hit quarter led control to boost its full-year income steerage from a spread of $4.80 billion to $5.00 billion to between $5.05 billion and $5.25 billion, or a 38% to 43% year-over-year build up.

Knowledge by way of YCharts.

DraftKings expects its adjusted EBITDA in 2025 to come back in between $900 million and $1 billion, marking an enormous milestone within the corporate’s historical past.

In the course of the first six months of 2023, DraftKings reported a $459 million running loss, however a 12 months later, that quantity has contracted to simply $171 million, an enormous growth.

There are nonetheless many states that experience but to legalize sports activities having a bet

When the U.S. Best Courtroom first introduced that states would have the authority to keep an eye on sports activities having a bet on their very own, just a few states had some type of legalized sports activities having a bet. Six years later, the quantity has jumped to 38 plus Washington, D.C.

DraftKings has two major techniques to develop: attracting new consumers in markets the place it already operates, and getting into new states that legalize sports activities having a bet at some point. There are not any set timelines for the latter, however you’ll be able to guess (no pun supposed) many of those holdouts will ultimately sign up for the bulk as the prospective tax income turns into too horny to forget about. Since June 2018, states have accumulated over $6.3 billion in taxes from sports activities having a bet.

DraftKings is easily situated for each alternatives, and it stays a best platform and inventory on this house.